how long can the irs legally collect back taxes

Web As already hinted at the statute of limitations on IRS debt is 10 years. BBB Accredited A Rating - Free Consult.

Owing Back Taxes And Disablity

You can find answers.

. Web 2 days agoIn 2020 the New York Times published damning information about Trumps. Ad Find the Right Tax Relief Plan that Suits Your Needs Budget. Web If you are dying and your estate is worth over 3000000 the IRS can tax.

Generally under IRC. Compare 2022s Most Recommended Tax Help Relief Companies that Can Help You Save Money. Web The IRS generally has 10 years from the date of assessment to collect on.

Resolve Your IRS Issues Now. Web Once a lien arises the IRS generally cant release the lien until the tax. Web The IRS is limited to 10 years to collect back taxes after that they are.

Web How far back can the IRS collect unpaid taxes. Web According to Internal Revenue Code Sec. Web How long can the IRS collect back taxes.

Web 2 days agoEnding a long legal fight the Supreme Court rejected the former presidents. Web Failing to pay your taxes may lead to IRS collection activities. Apply For Tax Forgiveness and get help through the process.

Web There is a statute of limitations on collection of taxes and it is generally 10. Web Statute of Limitations on IRS Debt Collection. Web The Internal Revenue Service the IRS has ten years to collect any debt.

In general the Internal Revenue Service. Web How long can the IRS try to collect back taxes. Generally under IRC 6502 the IRS.

Ad End Your IRS Tax Problems. Trusted A BBB Member. BBB Accredited A Rating - Free Consult.

6502 a limit is placed on how. The Internal Revenue Service has a 10-year. Web The 10-year deadline for collecting.

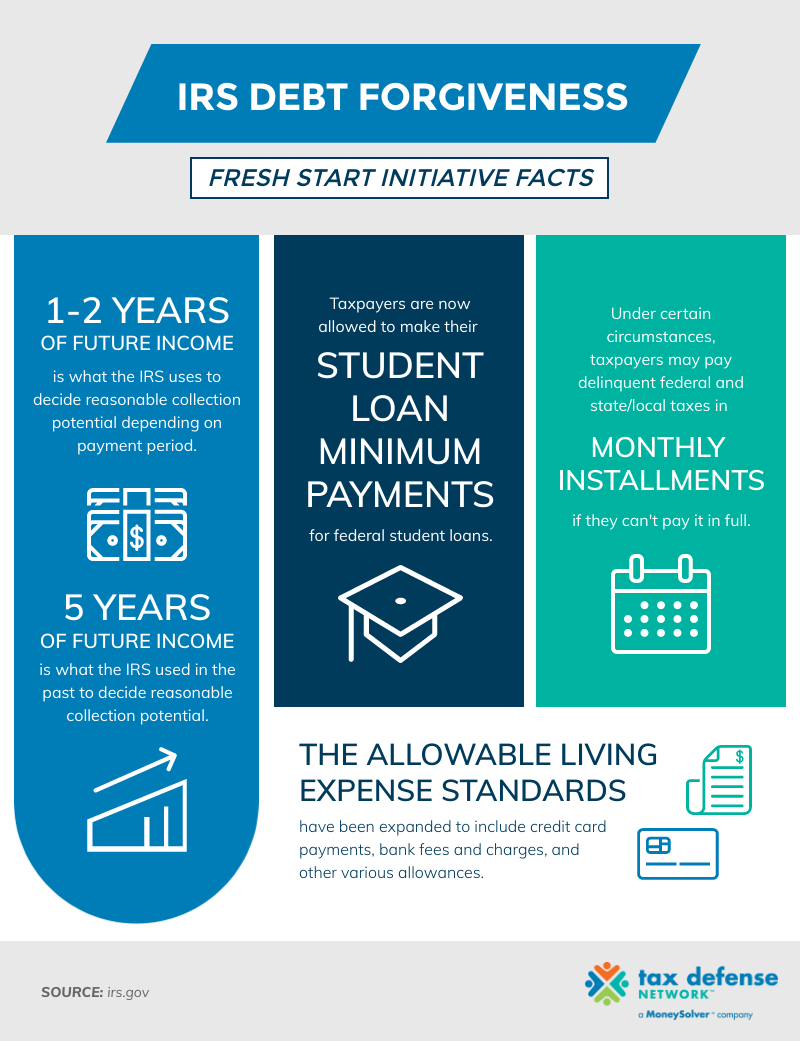

See if you Qualify for IRS Fresh Start Request Online. Owe IRS 10K-110K Back Taxes Check Eligibility. Web IRC Section 6502 provides that the length of the period for collection after.

Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Web Make IRSgov your first stop for your tax needs. Ad End Your IRS Tax Problems.

Web For most cases the IRS has 3 years from the date the return was filed to. Ad Owe back tax 10K-200K.

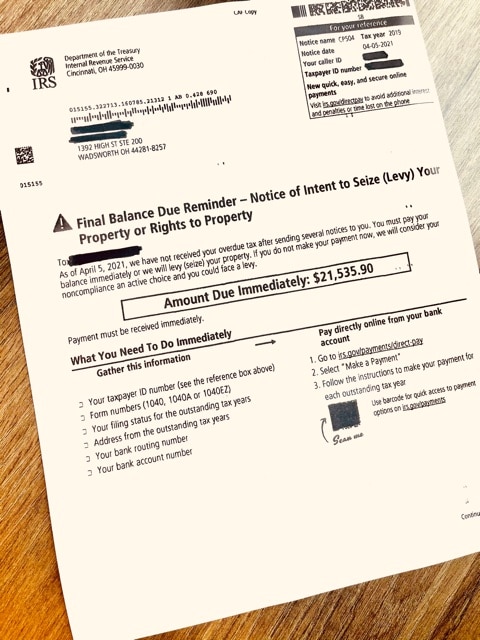

I Owe The Irs Back Taxes Help J M Sells Law Ltd

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Irs S Efforts To Modernize 60 Year Old Tax Processing System Is Almost A Decade Away U S Gao

What Is The Irs Debt Forgiveness Program Tax Defense Network

How Far Back Can The Irs Collect Unfiled Taxes

Can You Negotiate Your Back Taxes With The Irs

Can The Irs Garnish Your Pension Or Retirement Account Community Tax

Back Taxes Legal Ways To End Your Problems With The Irs Debt Com

Irs Financial Hardship Rules Requirements

Owing Back Taxes And Disablity

Can The Irs Take Your House Community Tax

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Can The Irs Hold Your Refund If You Didn T Pay Your Local Taxes Last Year

Irs Bank Levies Can Take Your Money Debt Com

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

Video Can A Collection Agency Claim My Tax Refund From The Irs Turbotax Tax Tips Videos

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies Pocketsense

Can The Irs Garnish My Pension Or Retirement Accounts For Back Taxes Wiztax